A new Oracle designed to improve the DeFi user experience and reduce governance overhead

In collaboration with our friends at Block Analitica, we have developed a novel yield rate Oracle, which tracks and delivers the value of the ETH staking yield rate on-chain in real time.

Drawing on our previous experience creating yield rate Oracles, such as the DSR (DAI Savings Rate) Oracle for MakerDAO, we recently announced the implementation of a new ETH staking yield rate Oracle for Spark via The Defiant.

The Oracle will track the staking yield rate of ETH to provide a safe and more convenient way for Spark to adjust the lending and borrowing rates the platform offers for WETH.

"Having an on-chain source for the Liquid Staking Yield allows Spark to optimize the capital efficiency of the ETH market. This means ETH suppliers get paid more, and Staked ETH loopers get a better yield. It’s a win for everyone." said Phoenix Labs Co-Founder Sam MacPherson.

Initially utilized for Lido-staked ETH (stETH), our staking yield rate Oracle could recalibrate to any well-capitalized and traded liquid staking derivatives, such as rETH or cbETH, creating a new Oracle to track the staking yield rate relative to that Liquid Staking Token (LST).

Unlocking automated, customizable interest rates

The benefit of this Oracle for DeFi is that it provides lending protocols, such as Spark, with a safe and automated way to customize the interest rate for WETH.

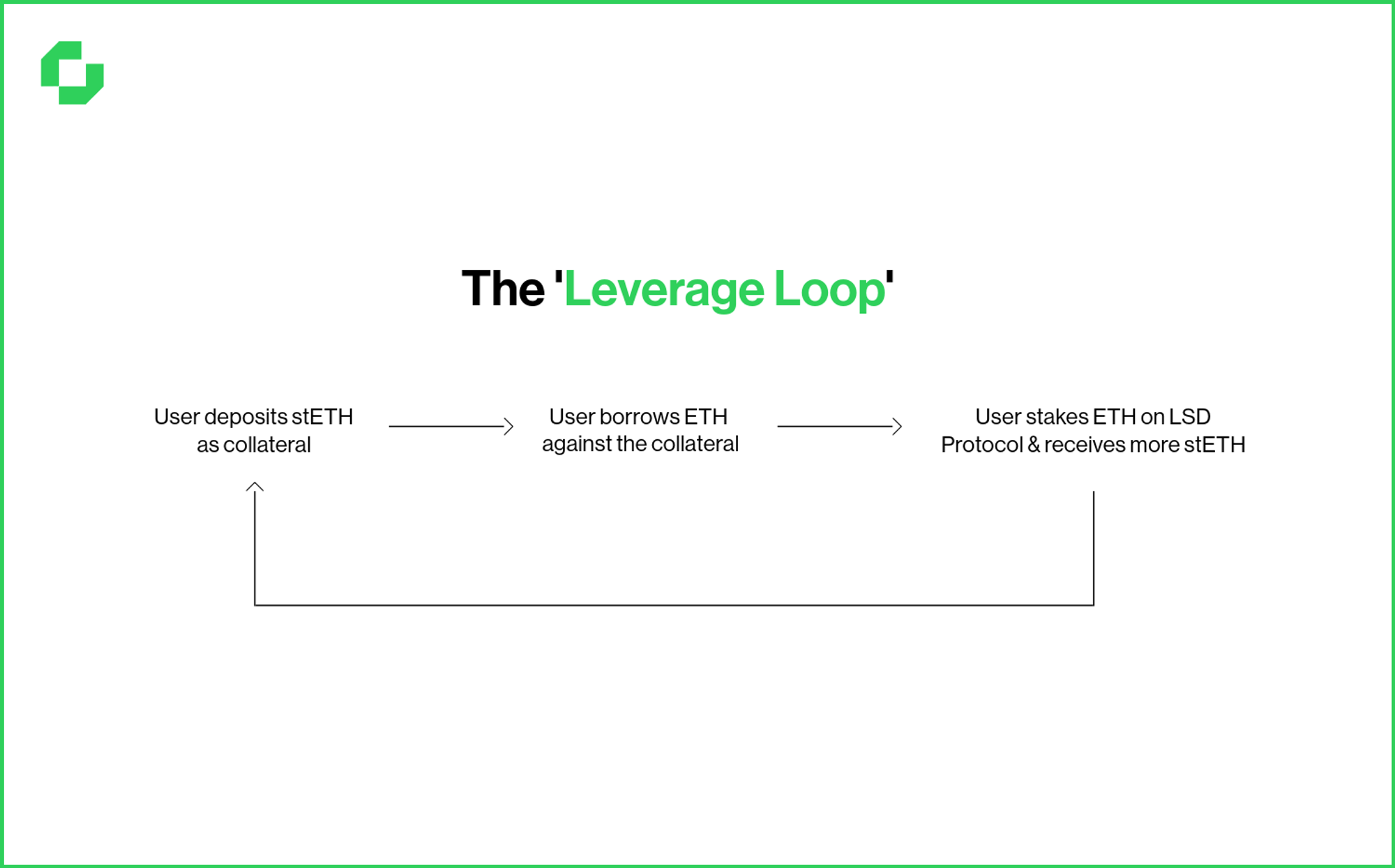

Currently, many decentralized lending protocols are setting these rates manually, updating them regularly to service demand for a popular yield strategy informally referred to as the ‘Leverage Loop’.

Ultimately, the liquid staking token interest rates derive from the Ethereum Staking Reward Rate, which fluctuates based on factors like block space demand, the amount of ETH staked at any time, and the total number of validators on the network.

Therefore, by tracking this rate and publishing the value on-chain via an Oracle protocol, DeFi gains access to the data it needs to customize the lending product interest rates of Liquid Staking Tokens automatically. This improves capital efficiency and eliminates a point of centralization, and the risk of moral hazard. ‘Sanity boundaries’ can also be built into the Oracle to ensure only values within a realistic range are reported.

“Chronicle’s Yield Rate Oracle is a huge unlock for defi protocols,” said Block Analitica Risk Analyst, MonetSupply. “In addition to improving user experience with predictable market-oriented rates, it also reduces ongoing governance overhead for managing parameters, improving functional decentralization and empowering contributors to focus on driving innovation.”

Utilizing our Scribe architecture ensures all the data is verifiable. This means that the reported data can be tracked from source to Dapp via The Chronicle dashboard, including context on how the value was reached, where the original data was sourced, and what value every Validator reported.

Ultimately, this is an Oracle that improves the efficiency and decentralization of all lending protocols in DeFi and is designed to provide secure, verifiable, real-time data on all high-quality Liquid Staking Tokens.

Interested in integrating this Oracle, or a variation of this yield rate Oracle, into your DeFi protocol? Reach out to the team via the website, Discord, or via [email protected]